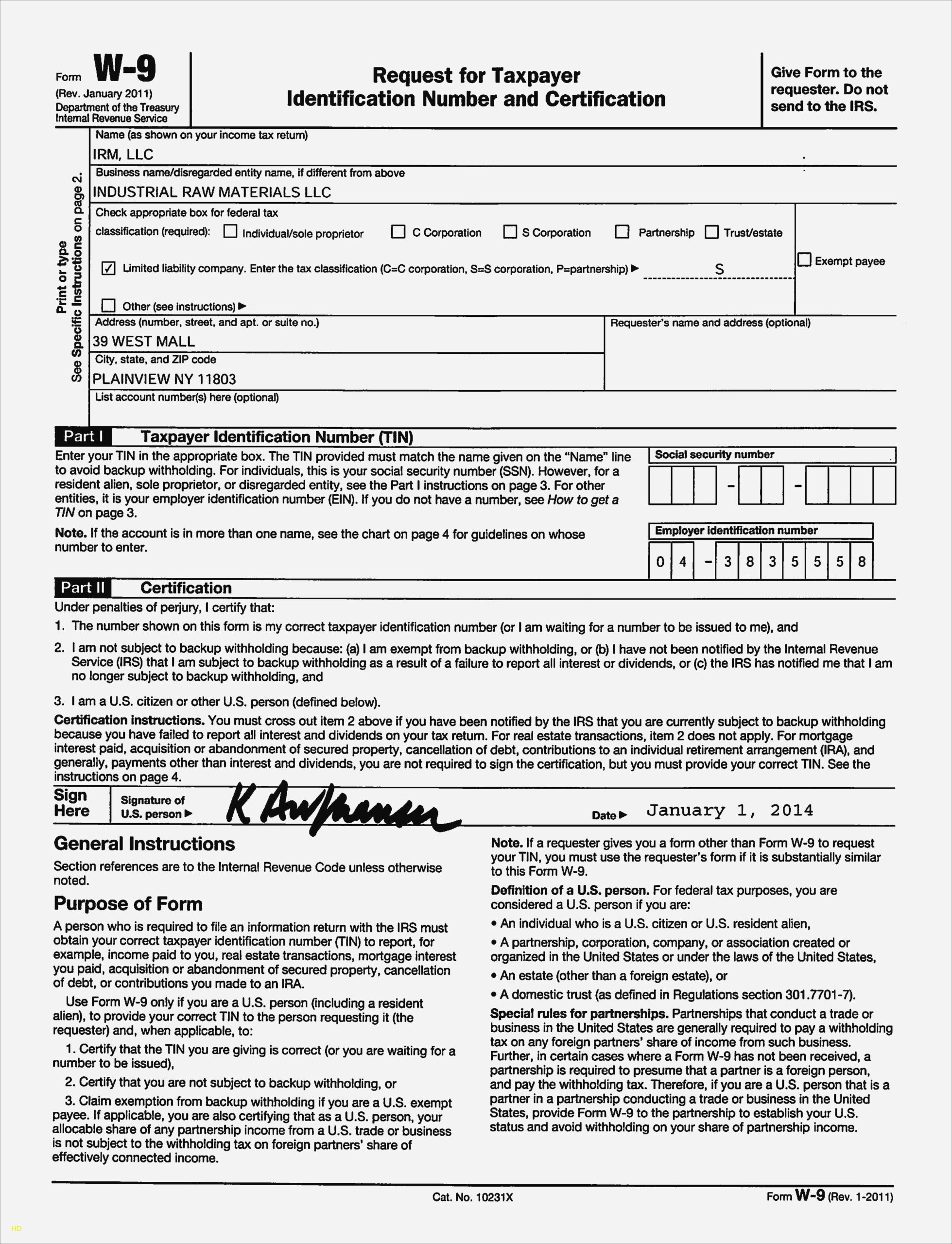

You may be sent a W-9 by your employer, otherwise, you can easily access an up to date copy via the IRS website (irs.gov). You’ll use W-9 tax forms to set up payroll for employees and to create W-2s and 1099 forms for every employee and contractor during the federal tax season every year. If you manage payroll or taxes for a company, it’s important that you keep a completed W-9 on file for each active working employee and contractor. This is typically a fixed rate of 24% for the 2018 to 2025 tax years. It’s unlikely you’ll be subject to backup withholding, however, if you are the contractee then you will need to withhold tax from your pay. You will also need to include information about your ‘backup withholding’ status.

#W9 FORM 2021 FULL#

This guarantees that they have all of the information they need to file their taxes with the IRS, and to generate and send your 1099 for your personal income tax return.įorm W-9 will need information such as the contractor’s full name, the business’ name, what kind of business it is, and the tax identification number/Social Security number (depending on whether the contractor is a business or a sole proprietor). To ensure that you receive your 1099s in time for tax season, you’ll need to submit a completed W-9 tax form to each company prior to working on projects for them. To do that, you’ll need a 1099 form from each company that you’ve completed contract work. Your employer will not retain money for taxes, in the same way, they would for permanent employees, so you’re responsible for doing the accounting yourself. Who needs to complete a W-9 form? Independent contractorsĪs an independent contractor, you’re required to pay taxes on the income you earn and you must file a tax return with the IRS each year. Generally, if you’re an independent contractor, freelancer or sole proprietor, you will need to execute an IRS W-9 form. The tax requirements vary for different types of people, so you’ll need to check that you are a worker that requires the use of a W-9. Independent contractors, employees, and companies must ensure that W-9 tax forms are completed, filed, and updated. You won’t need to send these forms to the Internal Revenue Service (IRS), but you will need them to complete an employee’s form W-2 or 1099-MISC form each year. For example, this encompasses many kinds of self-employed workers and freelancers.Īs an employer, you should use form W-9 to keep records for each relevant contractor.

It’s the form you’ll need to fill out if you work in the United States as an independent contractor hired on a contractual basis for a company. Form W-9 is a tax-related document that employees fill out as part of their onboarding process providing the employer with important information such as the employee’s name, business entity, Social Security number, taxpayer identification number, and address.

0 kommentar(er)

0 kommentar(er)